Invox Finance – Invoice Lending on the Blockchain

What is invox finance? It’s invoice lending platform, if you think about a small business and the invoice, their customers they might not get payment for let’s say 45 – 90 to even 120 days in some cases very long time from when they actually do the job and get paid for it. This means that they can maybe struggle for finance and capital during that the interim period. So, what this platform intends to do is provide these businesses with a way to get money based on the invoice amounts. competition is in singular and it is populous, there is no other ICO or blockchain company that is offering the service at the moment. The differences between populous and invox, the populous platform doesn’t allow buyers in the service. The invox platform is actually going to connect the sellers, invoices and buyers on the same platform. It’s going to be much more involving and the buyers will also be rewarded with the invox tokens as well. Another difference between the two is invoices uploaded onto the populous platform, paper-based invoices making them static whereas the invox finance platform will incorporate dynamic invoice smart contracts. Allowing the contracts with invoices to be in a completely digital format and looking forward to actually eliminating any paper-based invoices. Another difference the populous platform requires investors to bid against each other as sort of auction for financing the invoices whereas the invox platform will provide everybody with equal access so there’ll be a large pool of sellers and based on what the investors risk preferences are and then this will basically eliminate the need for investors to undercut each other in an auction environment. You won’t be scrambling or bidding against each other, you’ll have a fair and equal chance to get involved. The other differences, populous requires investors to join together in a group so essentially, they’re forming a pool if they’re unable to fund larger invoices whereas the invox platform divides the loan in a number of fragments. This allowing a smaller investor to invest as well.

The invox finance is important because for companies especially they can run out of cash flow if the invoice doesn’t pay promptly. The other side of the coin is if they demand the invoice too quick then buyers are perhaps not going to use their services or buy their products because they have to pay quickly. Normally in business the invoicing is between 30 to 90 days, in some cases little as seven days and in other cases as long as 120 days. Seller might invoice on 30-day basis but within those 30 days if the invoice isn’t paid then they’ll struggle for cash flow and they need the financing, they need the cash flow to come in so what they’ll do is perhaps go to the bank for an overdraft or they will use funds from elsewhere. The way the traditional invoice financing works is, the financier takes the invoice from the seller and usually provides up to about 80 percent of the face value of the invoice. The financier making let’s say 20 percent on average off each invoice and this allows the seller to get the cash flow quicker and the financier can just sit and wait until the buyer pays and get rewarded with 20% of the total as a result. This normally depends on a number of factors and obviously the assessed credit rating of the seller, the strength of the financial position of the buyer as well. You’re going to take into account their current position at the moment whenever the invoices have been issued. The industry sectors the buyer and seller involved in and what type of documentation is available to confirm delivery of the product. A postal receipt, signed, some proof of work that’s been signed by the buyer saying that the works been done, contracts being completed or the goods have been received.

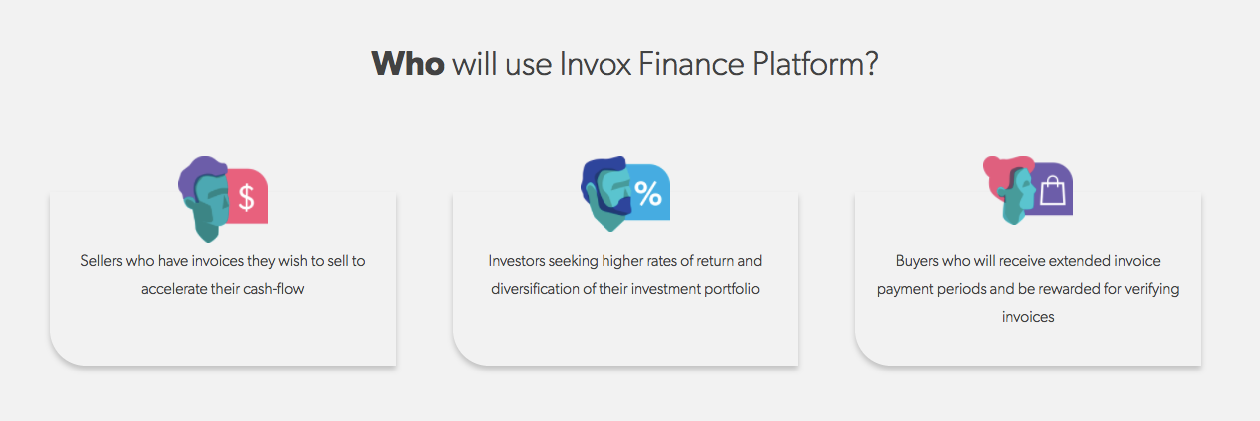

The main problem is the financier that purchases of the invoice from the seller who doesn’t have a relationship with the buyer. He’s basically stepping in as a debt recovery agent or whatever if the buyer refuses to pay and the financer has to rely on most of the information that’s provided by the seller. The relationship between the seller and buyer may not be completely transparent. The financier is taking the risk and in effect that’s what he’s getting paid the 20% for. It’s based on a relationship of trust between the seller and the buyer and this obviously has problems as the buyer and seller may collude or conspire to defraud the financier. The seller may be issuing an invoice for example for a service that has not been fully completed or a product that’s not complied with the agreed spec or requirements of the buyer. The buyer may also dispute the payment liability as well. The buyer may become insolvent and unable to pay for the invoices. There is also issues with the complexity of the processes, legal documentation etc. the preparation and execution of legal documents is laborious and costly and may involve a number of third party providers. As you can understand this is a relationship that’s based on trust and it brings with these inherent problems. If you’ve been involved in business and you’ve done any invoice financing, a lot of these problems will be pretty common to you and you will already be aware of them but if you’ve not and that’s really what the issues are and of course we’re talking about trust here so what better solution than a trustless platform such as the blockchain to implement invoice financing. Their aims are pretty simple they’re going to disrupt and revolutionize traditional invoice financing market and this is truly a disruptive ICO. This really will change the way invoice financing is done from the traditional model that I’ve already mentioned. By putting on the blockchain, you’re getting a more trustful platform, you’re getting a decentralized a platform that’s more secure and more private. Also allow all the parties to connect. The sellers, buyers and investors and other service providers. You will also get direct access to investors so sellers can go on and access individual investors to take invoices off them. It’s like a peer-to-peer lending environment as well and there’ll be lower rates for the sellers.

Website: https://www.invoxfinance.io

Twitter: https://twitter.com/InvoxFinance

Telegram: https://t.me/InvoxFinanceCommunity

Authored by: Leviitapochek

Bitcointalk url: https://bitcointalk.org/index.php?action=profile;u=1199539

Bitcointalk url: https://bitcointalk.org/index.php?action=profile;u=1199539

Комментариев нет:

Отправить комментарий